Is Reserve Rights the Best Way to Earn Yield on Real-World Assets? A Deep Dive into Reserve Protocol

In a market often obsessed with the next "moonshot" meme coin, it’s refreshing to see a project quietly building the plumbing for a more stable global economy. This week, we’re looking at Reserve Rights (RSR)—a protocol that isn't just trying to be another token, but a factory for stable, decentralized money.

If you’ve been following the shift toward Real-World Assets (RWA) and decentralized indexes, RSR is likely already on your radar. Here’s why it’s making waves right now.

Moving Beyond "Fragile" Stablecoins

Most of us use stablecoins like USDT or USDC daily. They’re convenient, but they have a single point of failure: centralization. If a bank account gets frozen or a reserve isn't transparent, the "stable" part of the coin disappears.

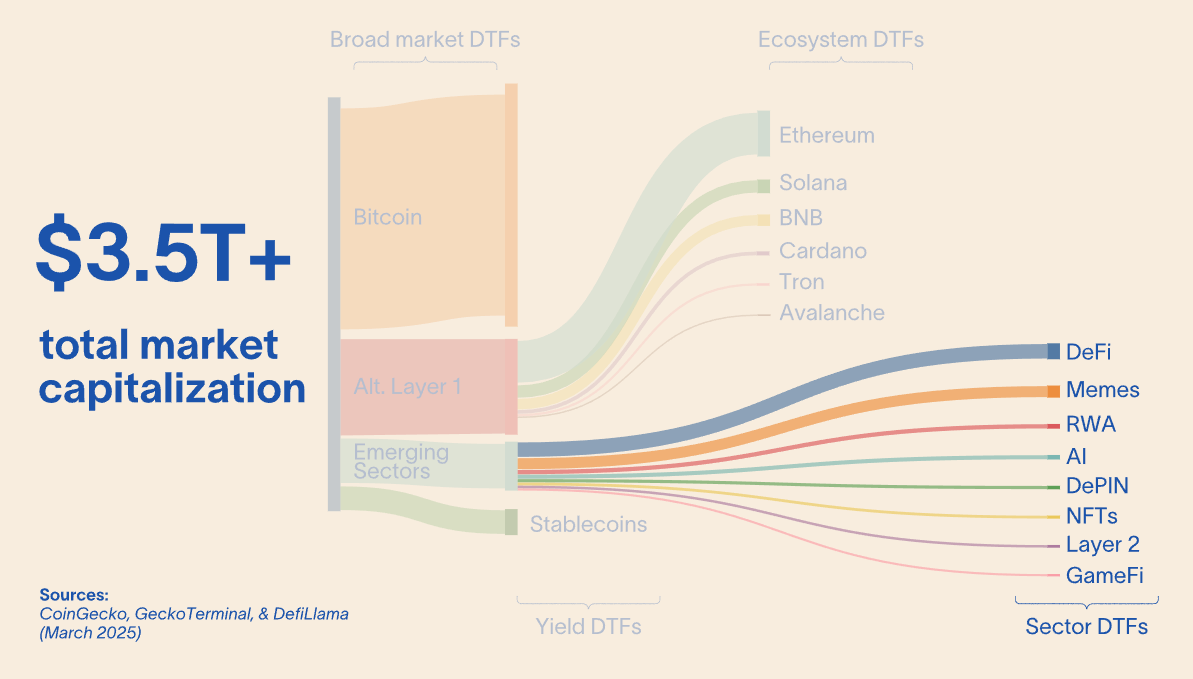

Reserve Protocol takes a different approach. It allows anyone to create Decentralized Token Folios (DTFs)—known as RTokens. Think of these as onchain, asset-backed baskets. Instead of trusting a single company, you’re trusting a smart contract backed by a transparent mix of assets.

How RSR Fits into the Puzzle

The RSR token itself serves a critical, "heroic" role in this ecosystem:

- Overcollateralization: RSR holders can choose to stake their tokens on specific RTokens.

- The Safety Net: If one of the underlying assets in a basket defaults (like a bank failure or a de-peg), the staked RSR is auctioned off to cover the loss.

- The Reward: In exchange for providing this insurance, RSR stakers earn a portion of the revenue generated by the RToken’s underlying assets.

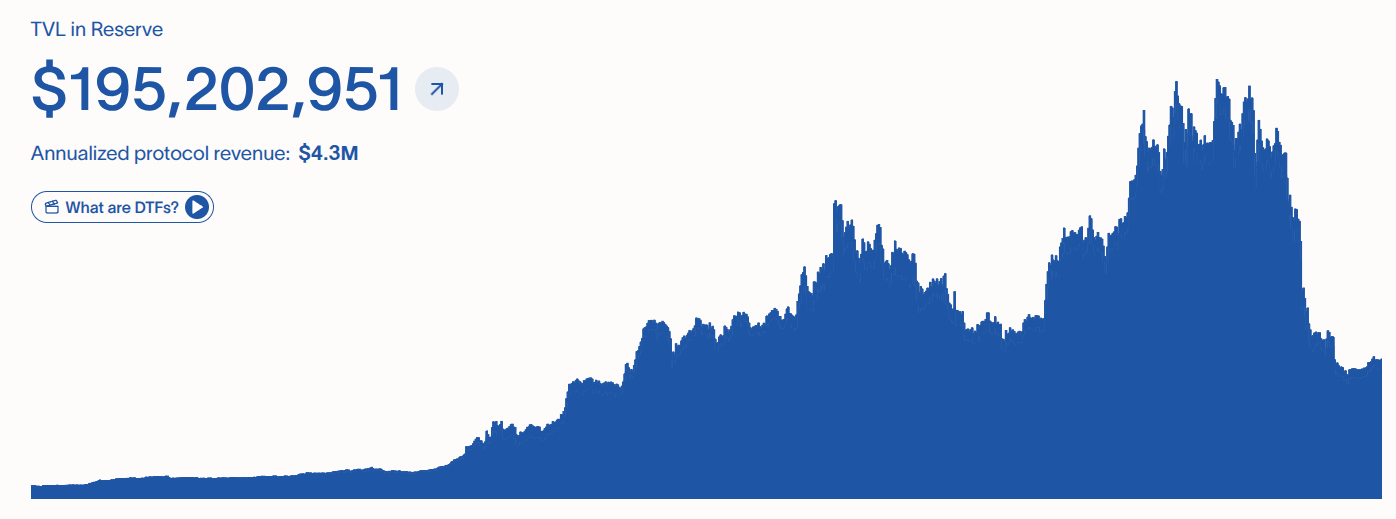

It’s a symbiotic relationship: RSR provides the security, and the protocol provides the yield.

From Peter Thiel to Community Power

The project's pedigree is hard to ignore. Early backing from heavyweights like Peter Thiel (Co-founder of PayPal) gave it the initial momentum, but the project has since evolved into a fully community-governed ecosystem. This shift to decentralization is vital for its mission—creating money that no single government or corporation can "turn off."

Real-World Impact: The Fight Against Inflation

While many investors treat RSR as a portfolio play, its real-world utility is already being felt. In regions facing hyperinflation, the ability to hold a stable, basket-backed currency isn't a luxury; it's a lifeline. As the tokenization of real-world assets (like treasury bills and gold) continues to explode, Reserve provides the infrastructure to turn those assets into spendable, stable global money.

The Bottom Line

Reserve Rights is positioning itself as the "backbone" of decentralized stability. By replacing fragile, fiat-dependent coins with transparent, community-governed indexes, it’s solving one of the biggest problems in crypto: trust.

Whether you're interested in the RWA narrative or looking for a project with deep technical utility, RSR is a fascinating study in how DeFi can actually improve global finance.